In a long-awaited moment in a hotly contested zone currently occupied by the Russian military, Ukraine’s citizens living in the peninsula of Crimea voted overwhelmingly to become part of Russia.

Responding to the referendum, President Barack Obama and numerous U.S. officials rejected the results out of hand and the Obama Administration has confirmed he will authorize economic sanctions against high-ranking Russian officials.

“As I told President Putin yesterday, the referendum in Crimea was a clear violation of Ukrainian constitutions and international law and it will not be recognized by the international community,” Obama said in a press briefing. “Today I am announcing a series of measures that will continue to increase the cost on Russia and those responsible for what is happening in Ukraine.”

But even before the vote and issuing of sanctions, numerous key U.S. officials hyped the need to expedite U.S. oil and gas exports to fend off Europe’s reliance on importing Russia’s gas bounty. In short, gas obtained via hydraulic fracturing (“fracking”) is increasingly seen as a “geopolitical tool” for U.S. power-brokers, as The New York Times explained.

Perhaps responding to the repeated calls to use gas as a “diplomatic tool,” the U.S. Department of Energy (DOE) recently announced it will sell 5 million barrels of oil from the seldom-tapped Strategic Petroleum Reserve. Both the White House and DOE deny the decision had anything to do with the situation in Ukraine.

Yet even as some say we are witnessing the beginning of a “new cold war,” few have discussed the ties binding major U.S. oil and gas companies with Russian state oil and gas companies.

The ties that bind, as well as other real logistical and economic issues complicate the narrative of exports as an “energy weapon.”

The situation in Ukraine is a simple one at face value, at least from an energy perspective.

“Control of resources and dependence on other countries is a central theme connecting the longstanding tension between Russia and Ukraine and potential actions taken by the rest of the world as the crisis escalates,” ThinkProgress explained in a recent article. “Ukraine is overwhelmingly dependent on Russia for natural gas, relying on its neighbor for 60 to 70 percent of its natural gas needs.”

At the same time, Europe also largely depends on Ukraine as a key thoroughfare for imports of Russian gas via pipelines.

“The country is crossed by a network of Soviet-era pipelines that carry Russian natural gas to many European Union member states and beyond; more than a quarter of the EU‘s total gas needs were met by Russian gas, and some 80% of it came via Ukrainian pipelines,” explained The Guardian.

Given the circumstances, weaning EU countries off Russian gas seems a no-brainer at face value. Which is why it’s important to use the brain and look beneath the surface.

ExxonMobil and Rosneft

The U.S. and Russian oil and gas industries can best be described as “frenemies.” Case in point: the tight-knit relationship between U.S. multinational petrochemical giant ExxonMobil and Russian state-owned multinational petrochemical giant Rosneft.

ExxonMobil CEO Rex Tillerson sung praises about his company’s relationship with Rosneft during a June 2012 meeting with Vladimir Putin.

Rex Tillerson (L), Vladimir Putin, unknown and Igor Sechin, Rosneft President and Management Board Chairman (R). Photo Credit: Russian Presidential Press and Information Office

“I’m pleased that you were here to be part of the signing today, and very much appreciate the strong support and encouragement you have provided to our partnership,” said Tillerson. “[N]othing strengthens relationships between countries better than business enterprise.”

A year later, in June 2013, Putin awarded ExxonMobil an Order of Friendship. But what does the friendship entail?

Putin and Tillerson. Photo Credit: Russian Presidential Press and Information Office

In 2012, ExxonMobil and Rosneft signed an agreement “to share technology and expertise” with one another. Some of the details:

–Forming of a joint venture to explore offshore oil and gas in the Kara Sea and the Black Sea

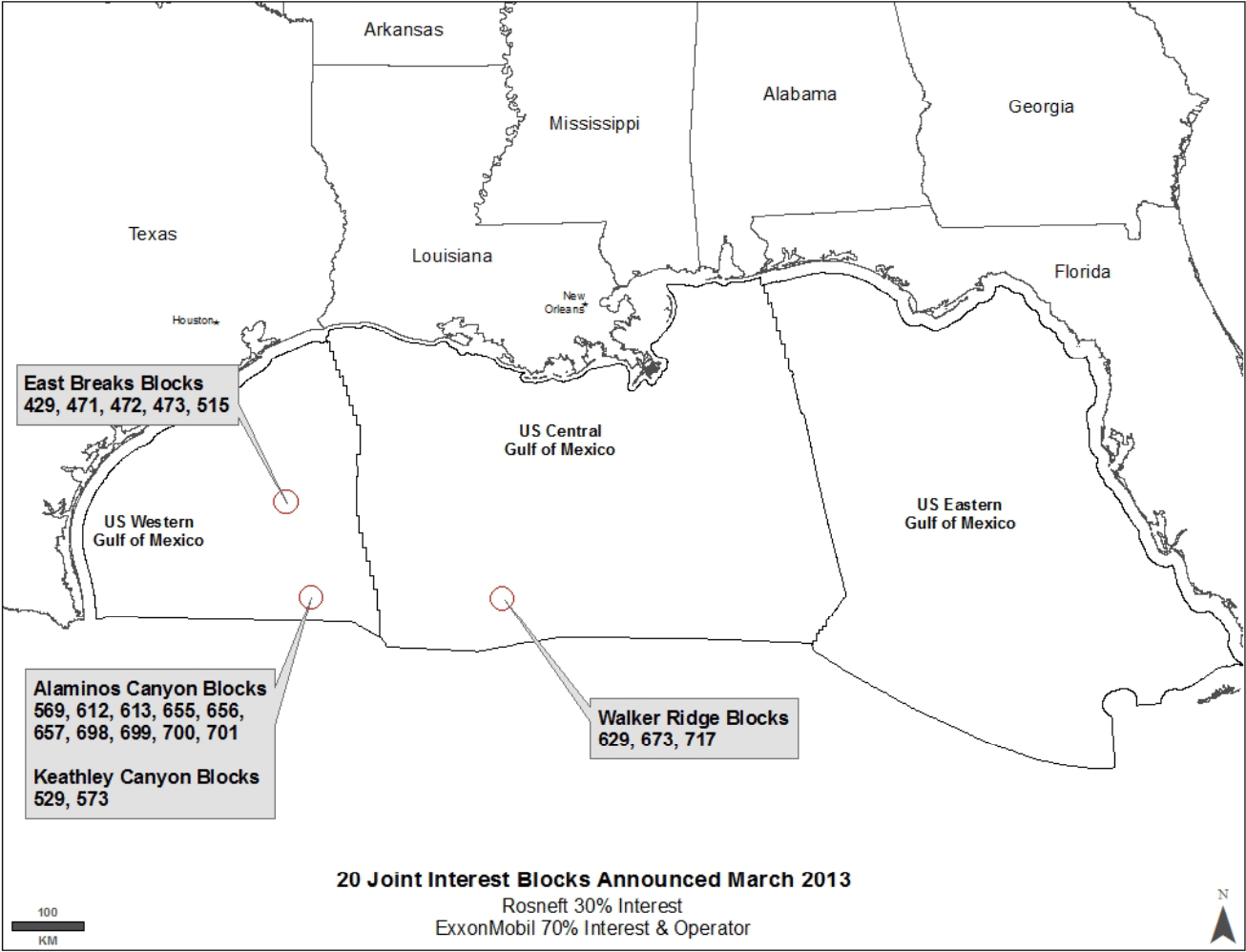

–Rosneft acquiring a 30 percent stake in 20 ExxonMobil-owned offshore oil and gas blocks in the Gulf of Mexico.

“The 20 blocks have a total area of approximately 111,600 acres (450 square kilometers) in water depths ranging between 2,100 and 6,800 feet (640 and 2,070 meters),” explained a Rosneft press release.

Map Credit: Rosneft

–Rosneft obtained a 30 percent stake in ExxonMobil’s share in the La Escalera Ranch project in the Permian Basin Shale in West Texas. It also gained a 30 percent stake in a portion of ExxonMobil’s stake in Alberta’s Cardium Shale formation.

In 2013, ExxonMobil and Rosneft announced a partnership to conquer the Arctic for oil and gas, creating the Arctic Research and Design Center for Continental Shelf Development.

ExxonMobil put down the first $200 million for the initial research and development work, while Rosneft threw down $250 million later. Officially, Rosneft owns 66.67 percent of the venture and ExxonMobil owns 33.33 percent.

“[S]taff will be located with the Rosneft and ExxonMobil joint venture teams in Moscow to promote resource efficiency and interaction between technical and management staffs,” explained a press release. “The [Arctic Research Center] initially will be staffed with experts from ExxonMobil and Rosneft.”

Also part of the 2013 deal, ExxonMobil gave Rosneft a 25 percent stake in Alaska’s Point Thomson natural gas field. Further, the two companies signed a Memorandum of Understanding to study the possibility of jointly building a LNG (liquefied natural gas) facility in the Russia’s far east.

Then at the end of 2013, ExxonMobil and Rosneft inked a deal to start a pilot project for tight oil reserves development in Western Siberia’s shale basins. Rosneft owns a 51 percent stake, ExxonMobil a 49 percent stake.

Despite the myriad ties to Russia, the DOE announced Exxon was one of the Strategic Petroleum Reserve buyers of 500,000 barrels of the five million barrels of oil the DOE offered up for sale.

Tillerson recently said the ongoing events in Crimea and Ukraine at-large will have no expected impact on his company’s partnerships with Rosneft.

“There has been no impact on any of our plans or activities at this point, nor would I expect there to be any, barring governments taking steps that are beyond our control,” he said at the company’s recent annual meeting, as reported by The Wall Street Journal. “We don’t see any new challenges out of the current situation.”

“Not a U.S. Company”

In Steve Coll‘s book “Private Empire: ExxonMobil and American Power,” he documents that Lee Raymond — former CEO of ExxonMobil from 1993-2005 — was asked if his company would build more U.S. refineries to fend off gasoline shortages.

Raymond’s reply: “I’m not a U.S. company and I don’t make decisions based on what’s good for the U.S.”

Lee Raymond with former U.S. Sen. Kay Bailey Hutchison (R-TXWikimedia Commons

So what does this all mean when looked at in aggregate?

As The Washington Monthly put it, “The clout, reach, and mission of ExxonMobil mean that it runs what amounts to its own foreign policy, raising the question of how that policy relates to the foreign policy of the United States.”

And ExxonMobil is not alone in this. ConocoPhillips, Chevron and Shell also have their own unique deals with Russia. BP operated in Russia for years until selling off its stake to Rosneft in 2012.

Climate Trump Card

Exciting as the energy geopolitics stand-off is to follow from afar, the climate disruption implications of it serve as the ultimate trump card.

“Sadly, few seem to care about diminishing the threat posed by climate change, since it has become increasingly clear that LNG would make things worse,” wrote ClimateProgress Editor Joe Romm in a March 12 article.

“First, natural gas is mostly methane, (CH4), a super-potent greenhouse gas, which traps 86 times as much heat as CO2 over a 20-year period. So even small leaks in the natural gas production and delivery system can have a large climate impact.”

It appears the U.S. push to export LNG has trumped climate change concerns, with export facilities in Freeport, TexasElba Island, GeorgiaLusby, Maryland all barreling ahead through the permitting process.

So even if the U.S. (and/or ExxonMobil) comes out ahead in this energy-centric geopolitical brouhaha, we still all end up losing in the end.

Photo Credit: Getty Images

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts