Renewable energy continued its explosive growth in 2015 — and I don’t mean explosive like an oil train accident.

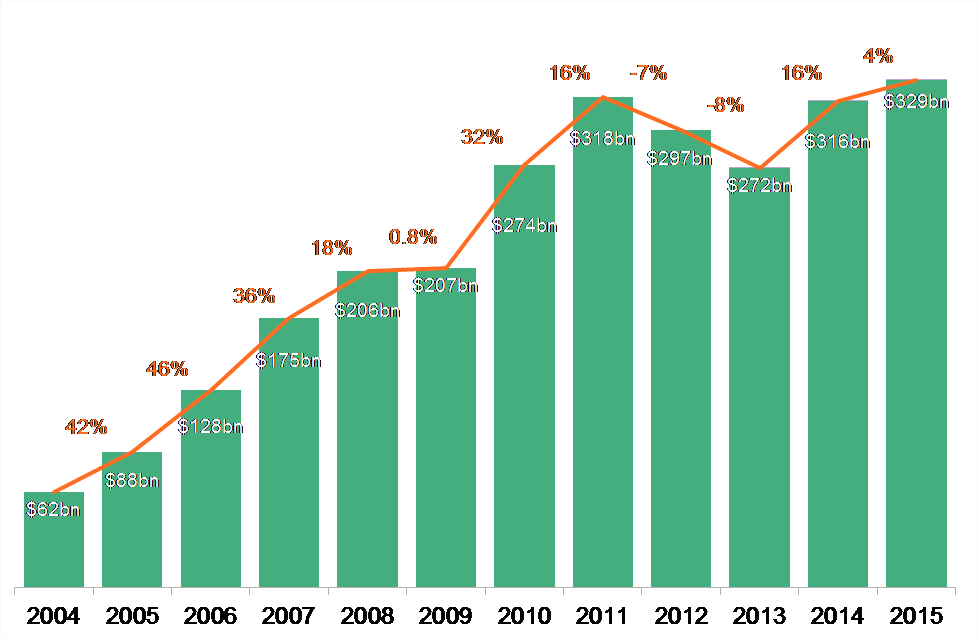

A new global record was set last year with the investment of $328.9 billion in clean energy. That edged out the previous high mark, set in 2011, by 3 percent, according to Bloomberg New Energy Finance.

The historic slide in fossil fuel prices over the 18 months that ended on December 31, 2015 was expected to slow renewable energy investment. The price of Brent crude oil ended the year down 67 percent, some types of coal were down by as much as 35 percent, and natural gas in the US dropped by nearly half.

The price of solar photovoltaic panels kept dropping, too, which was also expected to slow the rate at which funds were flowing to clean energy, since you could now buy more solar energy for the same amount of money. The persistent slump in the value of US currency and a sluggish European economy weren’t forecast to work in renewables’ favor, either.

But solar and wind proved resistant to all those trends, not only taking the bulk of the nearly one-third of a trillion dollars invested in clean energy worldwide ($161.5 billion was invested in solar in 2015, $109.6 billion in wind), but adding 121 gigawatts of generation capacity in 2015, as well. (Solar accounted for about 57 GW, while wind contributed 64 GW.)

That works out to roughly half of all new electricity generation capacity installed around the world using any technology, including fossil fuels, nuclear or renewables.

“These figures are a stunning riposte to all those who expected clean energy investment to stall on falling oil and gas prices,” Michael Liebreich, chairman of the advisory board at Bloomberg New Energy Finance, said in a statement. “They highlight the improving cost-competitiveness of solar and wind power.”

Graph via BNEF.

The bulk of global investment money — $199 billion — went toward utility-scale projects like wind farms, solar parks, and small hydroelectric dams. The second biggest share of the money — $67.4 billion — went to small-scale projects like rooftop solar.

Europe, traditionally a “powerhouse” of clean energy investment, according to BNEF, had just one country, the UK, increase investments in renewables relative to last year. Overall, European investments were down nearly 20 percent, with Germany and France seeing drops of 42 and 53 percent, respectively.

China continued to dominate the renewable sector in 2015, increasing spending on clean energy by nearly 20 percent to top out at $110.5 billion.

The US came in second at $56 billion, a nearly 10 percent increase over 2014. There were also reports that the number of solar jobs in the US more than doubled in the past five years — meaning that there are now more people working in solar energy than in oil, natural gas or coal extraction.

Even as European investment stalled out, BNEF says a number of “new markets” spent tens of billions of dollars on clean energy to more than pick up the slack, including Mexico ($4.2bn, up 114 percent over 2014), Chile ($3.5bn, up 157 percent), South Africa ($4.5bn, up 329 percent) and Morocco ($2bn, up from almost nothing in 2014).

BNEF’s Liebreich doesn’t think these trends are going to reverse any time soon.

“Wind and solar power are now being adopted in many developing countries as a natural and substantial part of the generation mix: they can be produced more cheaply than often high wholesale power prices; they reduce a country’s exposure to expected future fossil fuel prices; and above all they can be built very quickly to meet unfulfilled demand for electricity,” he said.

“And it is very hard to see these trends going backwards, in the light of December’s Paris Climate Agreement.”

Image Credit: HP Productions / Shutterstock.com

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts