As Congress debates what, if anything, to do with the federal electric vehicle (EV) tax credit, the oil industry is fighting to kill the popular incentive, which is hitting some key milestones in the program.

In the final weeks of the current legislative session (and before Democrats retake control of the House), many groups with financial and other ties to Koch Industries are ramping up efforts to fight any expansion of the EV tax credit program, while throwing a Hail Mary attempt to cancel the tax incentive entirely.

Dueling Bills to Expand and Kill the EV Tax Credit

The electric vehicle (EV) tax credit, first established under the George W. Bush administration and updated under a 2009 law, offers $7,500 in tax benefits to consumers and comes with a 200,000 cap on the number of vehicles sold by manufacturer; once that cap is reached, the credit is gradually phased out over the next 12 months.

Tesla has already reached the cap and General Motors (GM) is about to exceed it.

Members of Congress on both sides of the aisle have introduced several bills this fall addressing the tax credit.

Sen. Jeff Merkley (D-Ore.) and Rep. Peter Welch (D-Vt.), along with other Democratic co-sponsors, propose extending the tax credit through 2028 and eliminating the 200,000 vehicle cap.

“It’s crazy that we might allow the electric vehicle tax credit to run out just as the American EV market is starting to gain a foothold,” Merkley said in a September statement announcing the legislation. “Every day, we see the effects of climate chaos all around us — record-setting droughts, out-of-control wildfires, destructive mega-storms, and spreading insects and ocean acidification. Market-based incentives that help EVs compete with gas-powered cars are not only good for our economy, they’re essential to our future.”

Ford Raptor F150 truck. Credit: Doug Kline, CC BY–NC 2.0

Meanwhile, a pair of Republicans, Sen. Dean Heller of Nevada, home to the Tesla Gigafactory, and Rep. Diane Black of Tennessee, where Nissan manufacturers its Leaf EV, are sponsoring bills to lift the cap and extend the credit to 2022. But even this more moderate extension has come under fire by ardent EV opponents, particularly Koch Industries.

In October Koch lobbyist Philip Ellender sent a letter to senators strongly urging them to oppose Heller’s proposed extension to 2022. The letter claimed that Koch Industries supports ending all energy subsidies, including ones that it benefits from. In reality, the Koch industrial empire has fought for years to preserve petroleum subsidies and tax breaks.

A third set of bills endorsed by Koch-funded groups would not only eliminate the EV tax credit, but also impose a “user fee” on non-gasoline vehicles. Wyoming Sen. John Barrasso — who took in $45,400 from Koch Industries from 2013 to 2018, including $15,400 just this year — and Ways and Means Chairman Rep. Kevin Brady of Texas, also a Koch ally, introduced these bills.

An October press release from the Senate Committee on Environment and Public Works, which Barrasso chairs, cites an estimate from the Manhattan Institute that axing the tax credit would save $20 billion in taxpayer dollars over the next decade.

The Manhattan Institute has financial ties to the Koch network and ExxonMobil and has questioned the role of human activity in causing climate change.

Koch Groups Fight to Keep American Drivers Addicted to Oil

With transportation now the largest source of greenhouse gas emissions in the U.S., and with improved battery technology and declining costs, zero-emission electric vehicles are becoming more enticing to American consumers and policymakers. California is leading the way, with EVs comprising 10 percent of new vehicles purchased.

According to AAA, 20 percent of Americans surveyed say they plan to purchase an EV for their next vehicle, up from 15 percent in 2017.

“Today, electric vehicles have mainstream appeal,” said Greg Brannon, AAA’s director of automotive engineering. “While concern for the environment is still a major motivator, AAA found U.S. drivers are also attracted to the lower long-term costs and advanced technology features that many of these vehicles offer.”

This is a concerning trend for the profiteers of petroleum-based transport.

“We’re starting to see more attention given to this by Koch-funded groups,” said Don Anair, research and deputy director of the Clean Vehicles Program at the Union of Concerned Scientists. “EVs are starting to take a chunk of the market, and it’s becoming more of a threat to the oil industry.”

Unsurprisingly, the opposition to electric vehicles and policies that support them is funded almost entirely by the oil industry, and largely by the fossil fuel billionaire Koch brothers.

In the case of the federal tax credit for EVs, any bills extending or eliminating it would first have to pass through the Senate Finance Committee and the House Ways and Means Committee. The Kochs have contributed cash to Republicans on both committees.

According to one analysis, “Since 2013, Koch Industries has given $253,600 to 11 of the 14 Republicans on the Senate committee and $374,000 to 21 of the 24 Republicans on the House committee, including Chairman Brady.”

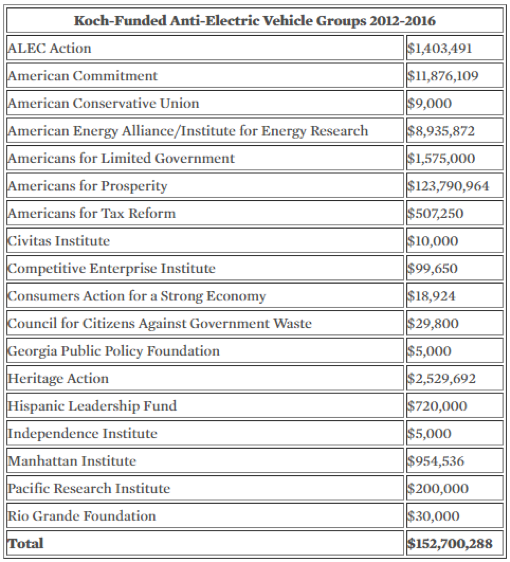

That same analysis, based on reviewing data from Koch-controlled foundations’ 990 tax forms, shows that a number of nonprofit groups advocating against EV incentives received Koch funding from 2012 to 2016.

Source: Union of Concerned Scientists

The Koch network’s two main arguments against electric vehicles are that they are too expensive and they have little environmental benefit. These arguments are disseminated via think tank studies and in conservative media outlets and op-eds.

The Manhattan Institute study published in May claims that the environmental benefits of EVs are questionable and don’t justify the high cost.

Another study from earlier this year produced by the Pacific Research Institute emphasizes that EV tax credit beneficiaries are primarily wealthier households, while ignoring the fact that higher-income earners are more able to afford new cars in general and thus more likely to buy EVs. The tax credit further reduces the cost of EVs to help make them more affordable for all consumers.

Both Manhattan and PRI are recipients of Koch cash.

While electric vehicles may be innovative technological marvels, old-fashioned subsidies continue to drive the industry. https://t.co/Irow1o79fm

— Manhattan Institute (@ManhattanInst) December 13, 2018

The latest Koch-linked study criticizing the EV tax credit makes the misleading conclusion that the policy will have a net negative economic impact resulting in declining household incomes — a point the Daily Caller trumpeted as a warning “of dire consequences.”

That study was commissioned by a Koch Industries subsidiary called Flint Hills Resources, and the firm that produced the study — NERA Economic Consulting — has a history of drawing up anti-regulatory reports funded by polluting industries, including the tobacco industry.

The bottom line is that non-gasoline electrified transport directly challenges the Kochs’ bottom line.

“The Koch industry wants to maintain the status quo,” said Anair. “That’s how they benefit.”

Encouraging EV Expansion

On the other side of the issue, automakers and utilities are banking on a future of increasingly electrified transport and have lobbied in support of extending the EV tax credit. Companies like GM, Nissan, and Tesla have teamed up with advocacy groups and other EV interests to form the EV Drive Coalition, which is urging Congress to lift the cap and maintain the credit in order to “level the playing field.”

In March, a group of over three dozen utilities and the trade group Edison Electric Institute sent a letter to Congress in support of lifting the cap.

“Eliminating the manufacturers’ cap will provide certainty to both automakers and consumers. It will also allow the utility industry to enable an electrified transportation future that creates and sustains more American jobs, reduces our reliance on foreign oil, makes our air cleaner, and our communities more sustainable,” the letter concludes.

Electric vehicles are undeniably less polluting than their gas-engine counterparts.

“No matter where you live in the country, comparing EVs charged on the local electricity grid with gasoline vehicles, the electric vehicles have lower global warming emissions,” Anair explained. This is the case today, and will only improve as the grid gets cleaner.

Credit: Aayush Srivastava, Pexels

As for cost, the upfront sticker price remains a barrier to widespread EV purchasing. However, as with any new technology, the price point continues to plummet as innovation improves.

“We’ve seen a lot of progress on the cost of the vehicles. We’ve seen battery costs drop from about $1,000/kwh [kilowatt hour] to about $200/kwh,” said Anair.

He and other clean vehicle researchers have identified that within the next decade, based on cost trends, EVs will start to become cost-competitive with gasoline vehicles. Beyond the up-front cost, they are already competitive with conventional cars.

According to AAA, electric vehicles fall slightly below the average annual cost to own and operate a new vehicle in 2018. That average cost is $8,849, which includes cost of fuel, maintenance, repairs, insurance, license/registration/taxes, depreciation, and loan interest.

For EVs, the estimated annual cost is $8,384 — higher compared to costs for small sedans/SUVs and hybrids but lower than annual costs for larger vehicles and pickup trucks. As more affordable EVs reach market, the annual cost of ownership will drop even more substantially, as depreciation and loan interest expenses make up the lion’s share of EV annual costs.

For all the noise the Koch network makes about the cost of the EV tax credit, it is silent when it comes to the price consumers pay continuously filling up at the gas pump.

According to MarketWatch, rising oil prices resulted in Americans shelling out an additional $4.4 billion in April of this year compared to April 2017.

Gas prices in 2018 could be the highest in four years, according to GasBuddy’s annual #Fuel Price Outlook report. How much will you be paying at the pump? https://t.co/nBj0odyKed pic.twitter.com/kkKuIC9N5M

— GasBuddy (@GasBuddy) January 3, 2018

The Bureau of Labor Statistics calculated that Americans spent nearly $2,000 on average on gasoline and motor fuels in 2017, up 3.1 percent from 2016. In total, U.S. spending at the pump amounts to hundreds of billions of dollars annually. Gas Buddy projected Americans would spend $364.6 billion on gas this year.

By contrast, electric vehicles offer much lower fuel and maintenance costs and additional benefits. “There’s a lot of evidence out there pointing to a future where the transportation system that is largely electrified has a lot of co-benefits in terms of electricity grid management and fuel cost savings,” said Anair.

He noted that it’s unclear how the tax credit will fare in the coming negotiations in Congress. But there is a strong economic case to be made for extending the credit.

“Undoing the tax credit now would be completely contradictory to the point these Koch-funded groups are making that the credit is bad for lower and moderate income families,” he said. “It’s exactly at the point where we’re getting these EV technologies in that range where the tax credit can tip the scale to make the vehicles affordable options for lower income families.”

Main image: 2018 Nissan Leaf SL Credit: Courtesy of AAA

Subscribe to our newsletter

Stay up to date with DeSmog news and alerts